East Bay Poised for Robust Economic Growth in 2016

East Bay Poised for Robust Economic Growth in 2016

Recent Increases in Employment, Spending, Real Estate and Construction Expected to Continue

As we enter 2016, the previous years of economic growth and development in the East Bay and Tri-Valley provide plenty of reasons to be optimistic about the future. New companies are moving into the area, employment continues to rise, and the foundation is in place for all these positive trends to continue. Those are the findings of the Economic Outlook report for 2015-16 from the East Bay Economic Development Alliance (East Bay EDA) as well as the group's recent quarterly update, the Regional Intelligence Report, prepared in partnership with Beacon Economics.

The numbers tell the tale. The East Bay EDA and the expert staff at Beacon Economics observe that the regional economy continues to move forward, building on the economic expansion that emerged following the Great Recession. Virtually every major economic indicator is trending in the right direction, a sign that indicates the potential for steady growth. As the Economic Outlook report notes, "From the job market to spending and real estate, the East Bay remains one of the bright spots in the state of California."

This information comes from the best of sources. With over 20 years serving Alameda and Contra Costa counties, the East Bay EDA provides a variety of services to the companies, research institutions, community organizations, small business leaders, and government agencies that make up its membership. With a focus on creating a thriving business climate, the organization serves as a vehicle for collaboration among East Bay leaders to achieve a shared goal of a healthy, vibrant economy to create and sustain quality jobs.

East Bay Employment Numbers are Strong, Rising

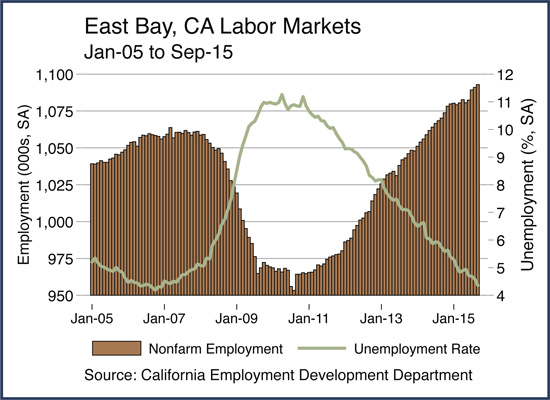

At the close of the third quarter of 2015, non-farm employment in the East Bay showed an increase of 2.1 percent year over year, to a total of 1.09 million jobs. Significantly, the region's unemployment rate fell to 4.3 percent, its lowest level since the financial crisis. The rate continues to be lower than both statewide and national averages.

The primary factor cited for the labor market's growth? Companies of varying sizes and types are moving to the East Bay at what the EDA says is, "an unprecedented rate." These relocations are motivated at least in part by lower rents across all property types. According to the Regional Intelligence Report, rent per square foot in the second quarter of 2015 for:

-

Office space was 42.9 percent cheaper than in San Francisco and 22.5 percent cheaper than in the South Bay.

-

Class A office space was 42.7 percent cheaper than in San Francisco and 24.1 percent cheaper than in the South Bay.

-

Class B office space was 38.7 percent cheaper than in San Francisco and 23.3 percent cheaper than in the South Bay.

-

Retail space was 17.5 percent cheaper than in San Francisco and 12.5 percent cheaper than in the South Bay.

-

Warehouse space was 39 percent cheaper than in San Francisco and 12.5 percent cheaper than in the South Bay.

"Companies are relocating to the East Bay because of more affordable property options, access to world class talent, access to valuable transportation options, and high quality of life standards," mentioned Supervisor Candace Andersen regarding the attractiveness of the East Bay for businesses. This means that companies migrating to the East Bay can save hundreds of thousands of dollars more in rent than companies that renew multi-year leases in urban centers elsewhere in the Bay Area. The East Bay EDA notes that the pace of relocation is showing no signs of slowing down for either office, retail, or warehouse space.

The combination of a resurgent economy and the relative bargains in commercial space mean that the employment picture is likely to continue to show strong gains. The report also notes that nearly every employment sector has been gaining jobs "because of the wide variety of companies, including design firms and law firms, moving to the East Bay to cater to the growing population and corporate presence."

Tri-Valley Continues to Grow its Reputation as an Innovation Center

In 2012, the East Bay EDA publication "Building on Our Assets" identified the Tri-Valley as a nascent center of innovation. "The Tri-Valley is an integral component of the Bay Area economy. With its robust research and development infrastructure and its growing entrepreneurial environment, the Tri-Valley region is no longer just a nice place to live - it has become a vital node in the Bay Area innovative system," said Dale Kaye, CEO of Innovation Tri-Valley. Thanks to the confluence of ground-breaking businesses, national laboratories, and the collective brainpower of experts in a wide variety of disciplines, the region is a magnet for both ambitious entrepreneurs and established industry leaders seeking to break new ground in their fields. Industries that have benefited from this synergy include engineering, scientific research and development, biotechnology, pharmaceuticals, biofuels, and other clean energy activities. Local businesses talk highly of the region's assets. "There is lots of high energy and skilled people here. The facilities, infrastructure, and the community is first class. It matches anything around the Bay Area and is a perfect spot. The area is a growing mecca for tech companies," said Giles House, chief marketing officer for CallidusCloud during a recent interview for the 2016 East Bay EDA Innovation Awards.

That trend continues today. In 2014-15, Oakland, Pleasanton, Fremont and Berkeley led all East Bay cities in venture capital funding, primarily due to substantial investment in the industries heavily concentrated in those cities: Industrial/Energy, Biotechnology, Consumer Products and Services, and Software.

It is important to note, however, that the current boom in venture capital funding differs substantially from that of the late 1990s. As reported in the East Bay Economic Outlook report, "what differentiates the current technological boom from the boom-and-bust period of the late 1990s is that in the current case, firms receiving substantial amounts of venture capital funding are older, more stable firms. Data for East Bay venture capital funding clearly demonstrates that most venture capital funding is going to firms in later stages of their development. From the first quarter of 2014 to the third quarter of 2014, just 2.4 percent of all venture capital funding went to firms in the seed stage. Over three-fourths of venture capital funds were expansion-stage or later-stage funds."

This emphasis on funding more mature, stable ventures means that the current venture capital boom is much less volatile and unlikely to crash, according to the report.

East Bay Spending Growth Also Reflects Strong Economy

Spending is another valuable indicator of economic activity, and it, too, is on the rise. As mentioned above, there are more people and companies in the area now, and that helps increase spending. In the second quarter of 2015, taxable sales rose 4.6 percent year over year - twice the 2.3 percent increase seen in San Francisco and significantly higher than the 3.9 percent spending increase in the South Bay. Alameda County showed a particularly strong year-over-year increase of 6 percent. The Tri-Valley showed similar strength from the fourth quarter of 2013 to the fourth quarter of 2014, with a 6 percent increase in taxable spending.

With the sole exception of Fuel and Service Stations - oil prices are down worldwide - East Bay spending increased in every category, year over year. The categories with the most dramatic improvements were Building and Construction, Autos and Transportation, and Restaurants and Hotels, all of which saw year-over-year gains in excess of 11 percent. The report notes that, "rising spending for Autos and Transportation is a particularly good sign since a willingness to spend on big ticket durable goods indicates long-term consumer confidence in the economy," which makes that category's two year growth of 23.6 percent a particularly telling statistic.

Spending in the Restaurants and Hotels category has also seen two year growth of over 20 percent. Business travel has been growing as the economy recovers and Livermore's Little League World Intermediate Series, an event started just three years ago, attracts more than 30,000 international visitors each year. The East Bay has also been recognized by a number of national and international publications as a travel destination in recent years. All told, hotel occupancy rates and average daily rates in the region have surpassed pre-recession levels. The average daily rate rose to $143.21, a 14.8 percent year over year increase, and occupancy increased 2.4 percent to 88.9 percent in July, 2015.

The increased levels of spending and consumer confidence are also reflected in business spending. As the Regional Intelligence Report notes, both existing and new companies in the area are expanding, investing in R&D, obtaining intangible and tangible assets, and upgrading their technologies to improve security, efficiency, and use of their work space. Thanks to increased confidence and greater projected returns, companies are no longer cutting spending or delaying investments in either big ticket items or projects.

Based on current trends in the market, Beacon Economics believes that spending in the region will continue to rise as both companies and individuals relocate to the area, nor does the company foresee any near-term deceleration of the migration of people and firms to the East Bay. "Robust local spending growth," the report says, "is expected to continue."

Real Estate Market Thriving as Well

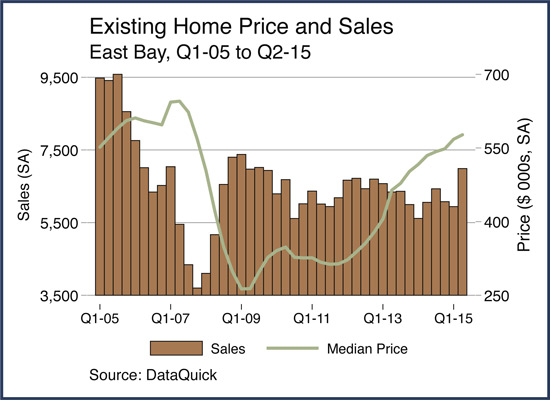

With virtually every other area of the economy thriving, it should be no surprise that the demand for housing in the East Bay is also rising. Home prices, rents, and home sales have all increased, with the only concerns being related to supply: Only 2.1 months worth of homes were available as of September, where a six to nine month supply would reflect a more balanced market.

Nonetheless, the market is on the rise. Median home prices in the region rose 7.9 percent year over year to $576,900 in the second quarter of 2015, and while prices have been rising rapidly recently, they are still significantly lower than the median in San Francisco ($1,078,000) and the South Bay ($867,900). The number of homes sold in the East Bay is also higher, as sales of 6,900 homes in the second quarter of 2015 represents a 15.4 percent year over year increase and a 10.5 percent increase over their three-year average. The East Bay's rapid growth is reflected in how far the region outdistanced San Francisco and the South Bay, where sales grew 3.7 percent and 2.7 percent above their three-year averages, respectively.

Regional apartment rental rates saw increases as well, with a 6.2 percent year over year rise to $1,670. This average is still much lower than either San Francisco ($2,400) and the South Bay ($2,000) for the second quarter of 2015. Vacancy rates in the East Bay were also reflected in this increased demand, reaching a new low of 2.5 percent during the same time period.

The increased demand for housing is being anticipated by several projects currently underway in Hacienda. As part of a mixed-use, transit-oriented development close to BART, Essex Property Trust is constructing 251 apartments at Hacienda and Gibraltar drives (Galloway at Hacienda) and another 255 units at Owens Drive and Willow Road (Galloway at Owens), with initial availability targeted for this April. The Residences at California Center, a sustainably designed apartment community consisting of 305 units paired with 7,500 square feet of retail, has been approved for construction at Owens and Rosewood drives, and construction recently commenced on a new 94-unit for-sale residential community on W. Las Positas Boulevard from Summerhill Homes. These properties will all join Hacienda's existing rental properties, including the newly opened 168-unit Anton Hacienda on W. Las Positas Boulevard, the 540 units of Park Hacienda on Owens Drive, Springhouse Apartments, a 354-unit complex on Springhouse Drive, and the four for-sale residential communities developed by Signature Properties.

Beacon Forecasting a Bright Future

With the regional economy hitting on virtually all cylinders, it should not be surprising that the Beacon Economics future forecast anticipates continued growth, saying "the migration of individuals and firms to the East Bay will continue to grow strongly in the short and medium term, (with) employment, spending, real estate values, and construction... poised to continue their upward momentum."

Similarly, they forecast non-farm employment to rise 10.6 percent and the unemployment rate to fall to 4.1 percent by the fourth quarter of 2020. The anticipated increase in population and employment will correspond to a 28 percent rise in taxable sales, to $14.3 billion, by late 2020.

The rising employment figures are forecast to continue to cause increases in home prices and apartment rents. However, despite this dynamic, the region is likely to retain its affordability relative to both San Francisco and the South Bay. Beacon Economics foresees an increase in residential building permits from 7,135 in 2015 to 10,750 in 2020.

The East Bay EDA will be releasing an updated version of the East Bay Economic Outlook report, which will cover fiscal 2016-17, in May. It is one of several reports the organization publishes on a regular basis, along with its Regional Intelligence Report, the East Bay Quality of Life Report, and other titles that incorporate economic data from a number of sources. The group also provides information useful to East Bay businesses on a variety of levels, from access to capital to hiring, permitting, international trade, and more.

For additional information on the East Bay EDA, or secure a copy of the 2015-16 East Bay Economic Outlook Report, go to www.EastBayEDA.org. The Beacon Economics web site is available at www.beaconecon.com.

Also in this issue...

- IronPlanet is Riding a Wave of Acquisitions to New Growth

- R2P’s Products are a Dog’s — and a Cat’s — Best Friends

- Business Bits

- From the Football Field to Iron Man Triathlons, Joe Terry Takes Lessons From Athletics into Business

- IntegenX DNA Identification Device Hits a New Milestone

- Arta Print and Promotion Brings Latest Digital Technology to Hacienda

- East Bay Poised for Robust Economic Growth in 2016

- I-580 Express Lanes Provide Increased Efficiency to Vehicle Traffic

- Teen Esteem Offers Brown Bag Events with the Latest Parenting Tips

- Teens Get a Taste of Law and Government in Alameda County District Attorney’s Justice Academy

- Hacienda February Index

- Calendar